SAVING $8,000 A MONTH BY BUYING AN OFFICE (IN OUR SMSF)

6 Quick wins buying a business property in your family SMSF

I’ll start off by saying that as a serial entrepreneur, I was fairly “Anti-Super” for a very long time. That was until my best mate, business partner and tax wizard Ben Walker showed me how easy it was to become a SMSF Millionaire.

He’s an accountant, I’m not. So he’ll chime in every know and then during this blog with the technical bits.

Before we get started: this is not advice – personal or general – just what we’ve done, and sharing because people were asking!

For the busy reader, here are the 6 quick wins I experienced by buying our business premises in the family SMSF.

-

Did you know you can make voluntary contributions to superannuation to save thousands in tax?

Our family contributed about $100,000 to super to buy a commercial property and in so doing saved $32,000 in tax.

-

Did you know you can have 4 members in a Self Managed Super Fund?

This saved us thousands in retail super admin fees because we had literally 10 funds between the four of us.

-

Did you know you can pay for your life insurance premiums from super?

This put thousands a year back in our pocket as we switched our insurance premiums to come from the super fund instead.

-

Did you know you can have your SMSF buy your business premises and essentially become your own landlord?

This strategy saved us $8,000 a month in lease expenses and turned a common business expense into a family wealth stream.

-

Did you know we borrowed 75% LVR in our SMSF?

This meant we only put in around $150,000 cash plus a few expenses (from our super fund) to buy a $580,000 commercial property.

-

Did you know you can pay 0% tax on capital gains when a super fund is in ‘pension’ phase?

This could save us up to $136,300 in tax if our property doubles in value in the next 10 years.

That’s the quick summary. Now if you want to go into detail on these strategies, read on….

Paying Too Much Tax? Learn the 12 strategies that have proactively saved our business clients $3M+ in tax at the next 12 Tax Saving Strategies workshop coming up this month in BNE, SYD & MEL – www.inspireca.com/SaveTax

The little (coffee) shop of horrors…

Funny story, when we first launched Inspire CA 4 years ago, we also launched the Inspire Cafe. An accounting firm in the middle of a cafe, to break the mould on what a model accountant could look like. The idea was great, but the numbers didn’t really add up.

We were paying a GIGANTIC amount of rent each month for 250 square metres in Doggett st, Newstead.

12 months ago we managed to get out of our 7 year lease with 4 years to go (don’t ask how … ) and used that time to save up and buy our own office.

See, you can use your Self Managed Super Fund to purchase a Commercial Property and have your own business rent it off the SMSF as your business premises.

We bought a ‘renovators delight’ (aka complete dump) in the valley and after an extensive fitout, we’re aiming to move in in March 2018.

Best thing is, we’ll go from paying an eye watering amount of rent each month (to someone else) for 250 squares to paying our own super fund less than half of our previous rent for 160 squares, just 2 streets away. It works out to about a 7% return for the SMSF and we’ll pay ZERO tax on the capital gain when we sell it in 15 years.

That’s a win-win-win-win.

Crunching the Numbers

Saving almost half a million dollars in lease expenses

Right now, we’re in the shoes of our business – looking at the saving in rent.

Doggett St lease (250 square meters) – $11,500 plus GST / month

Ann St lease (160 square meters) – $4,000 plus GST / month

Monthly savings – $7,500 plus GST / month or $8,250

Annual savings – $90,000 plus GST / year or $99,000

Savings over 5 years – $450,000 plus GST or $495,000

Buying your business premises using your SMSF

So you’ve probably heard that you cannot use your SMSF to buy an apartment and have your family member rent it – that’s breaking the ‘sole purpose test’.

But did you know under certain conditions, you can use your SMSF to buy a commercial property and have your own business rent it from your SMSF. It’s amazing.

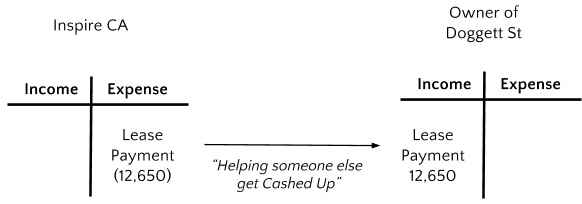

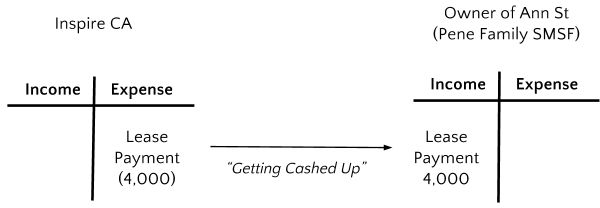

In our case not only were we paying a GIGANTIC amount of lease expense each month, but 100% of it went to the owner of the building.

Now the business pays a reasonable amount of lease expense each month and 100% stays in the family by being paid to the SMSF.

Put another way, by purchasing our business premises in our family SMSF we turned an business operations expense into a family wealth stream.

Before – Paying a commercial lease to someone else.

After – Buying our Business Premises in our Family SMSF.

[Watch] Buying Your Business Premises Using Your SMSF

What is 0% tax on a lot of money?

Around the Inspire office you can often hear Ben Walker saying “it’s impossible to get Cashed Up, if you’re giving half your profits to the tax man!” So let me tell you about the 2 x tax saving strategies we’re using in this deal.

1 – Additional Super Contributions – Saving us $32,000 a year in tax

One of the best ways you can reduce your tax legally is through making voluntary contributions to superannuation.

4 x members of the Pene Family Super fund contribute $25,000 each into super.

How much tax do we save?

$25,000 super contribution x 32% tax saving (47% tax rate outside of super minus 15% tax rate inside of super) = $8,000 tax savings each.

That’s a huge $32,000 per year tax saving for the 4 x members of the SMSF!

Woohoo, but that’s not the best part.

In the strategy corner with Ben Walker – Be careful to not exceed your ‘Contribution Cap’ for deductible superannuation contributions.

For the 2017 Financial Year (ending 30 June 2017) the Cap (or maximum you can put in, without additional tax) is based on your age.

If you’re 48 years or younger, the limit is $30,000 in the financial year.

If you’re 49 years or older, the limit is $35,000 in the financial year.

For the 2018 financial year (from 1 July 2017 onwards) both of these caps reduce to $25,000 regardless of age.

Going over the caps mean you pay an effective tax rate of 47% in tax. Ouch!

2 – Zero Tax in Pension – Paying 0% tax on $500,000 profit

Another killer tax saving strategy is that you can pay 0% tax on capital gains in a super fund if it’s in ‘pension mode’. How does it work?

We mentioned before that the tax rate in super is a flat rate of 15%. That’s how we saved 32% in tax (47% tax rate outside of super minus 15% tax rate inside of super) by making voluntary contributions into super.

What you may not know is that super funds have two tax rates. One for each phase it’s in –

15% tax when it’s in accumulation phase.

0% tax when it’s in pension phase and the member is over 60 years old.

What is the difference between pension phase & accumulation phase?

‘Accumulation phase’ is what we refer to when you’re working or running a business, and you’re actively accumulating a superannuation balance. Basically this is the phase you’re in, until you start taking a pension – then you switch to ‘Pension phase’.

‘Pension phase’ is when you start drawing down on the money in your superannuation. You can only do this once you’ve reached ‘preservation age’ (current 56 years old, and heading up). And pensions become tax free in most conditions once you’ve reached 60 years old!

Note: The following is a hypothetical assumptions (that we hope come true!)

The Pene Family Super Fund bought 915 Ann st for about $580,000 in 2018.

If in 10 years time we can sell it for $1.16M that will be a $580,000 capital gain or profit – aiming to double our money!

If we owned the property in my personal name I’d pay $136,300 tax.

$580,000 Capital Gain

Less $290,000 CGT Discount (50% is CGT free because we held it longer than 12 months)

Equals $290,000 Profit

Multiplied by 47% Tax Rate (because it’s in my own name, and I’m already a high income earner as a business owner)

Equals a whopping $136,300 tax payable.

Because we own the property in a Self Managed Super Fund, we’d pay $0 tax.

$590,000 Capital Gain

Multiplied by 0% Tax Rate on the most of the gain (because the members with the largest balances in the fund at that time will be in pension phase as 2 of its members reach 60+)

Equals a whopping $0 tax payable.

Have I got you excited yet? I sure am!

Check out the ‘BEFORE’ photos.

At 7% return it’s positive cashflow

I’m no property investment guru, but I bought my first property at 17. I’ve always worked on a simple ROI model that if I can get at least $100 of weekly rent for every $100K of Property Value, then it seemed like a good deal.

For example –

- A $500,000 Property, gets at least $500 / week rent.

- A $300,000 Property, gets at least $300 / week rent.

- A $180,000 Property, gets at least $180 / week rent.

That rule of thumb worked ok for me when investing in residential property but I was amazed to see how did it stack up in this commercial deal?

Ann St is about a $580,000 Property plus $100,000 for fitout and additional purchase costs.

So let’s call it $680,000 max to get it ready for rent.

And it gets $4,000 / month rent or just over $900 / week rent. Not bad. In all my years of investing I’ve struggled to find a deal like that.

Making 7% return by becoming our own landlord

$580,000 purchase price + $100,000 fitout = $680,000.

$4,000 / month x 12 months = $48,000 / year.

$48,000 rent / $680,000 Purchase Price = 7.06% return

Pay your Life Insurance premiums from Super – and get double tax benefits.

Life Insurance is money your family will receive in the event of you kicking the bucket.

Interestingly the premiums you pay for Life Insurance are not tax deductible, unless they’re paid from your superannuation.

Let’s say the premiums for your Life Insurance are $5,000 per year.

Option 1 (Without Tax Planning): Pay the $5,000 Life Insurance premium outside of super.

No tax deduction applies. If you’re on 47% tax rate you’d have to earn $9,434 before tax to then pay the tax and have $5,000 leftover to pay your Life Insurance Premiums.

Option 2 (With Tax Planning): Pay the $5,000 Life Insurance premium from your super fund.

First of all we need money into your super fund to pay the premium.

Business contributes $5,000 into Super.

This alone saves $2,350 tax, when compared to paying 47% tax in your own name.

Super fund pays 15% tax on $5,000 in super = $750 due.

Super fund pays $5,000 Life Insurance premium.

Super fund get 15% tax deduction for premium expense = $750 refund.

By paying your Life Insurance Premium from super, you’d save $2,350 in tax on the super contribution IN (when compared to paying tax in your own name) AND you’d receive a tax deduction for the $5,000 premium paid.

Any information and content on our website or social media property is general in nature only. It does not take into account the objectives, financial situation or needs of any particular person. So before acting on anything to do with your finances, you need to consider your financial situation and needs before making any decisions based on this information.

Benjamin Walker of Inspire SMSFS Pty Ltd (ASIC Authority 1243433) ABN 38 879 130 483 is an Authorised Representative of

Finance Wise Global Securities Pty Ltd ABN 60 146 708 045. Finance Wise Global Securities Pty Ltd holds Australian Financial

Services License No. 397877.